what is a fit deduction on paycheck

FIT is the amount required by law for employers to withhold from wages to pay taxes. What is fit on my paycheck.

What Are Employer Taxes And Employee Taxes Gusto

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

. All wages salaries cash gifts from employers business income tips. What is the fit tax rate for 2020. This amount is based on information provided on the employees W-4.

The federal income tax rates remain. What it is and how it affects wages and withholding. The FIT deduction on your paycheck represents the federal tax withholding from your gross income.

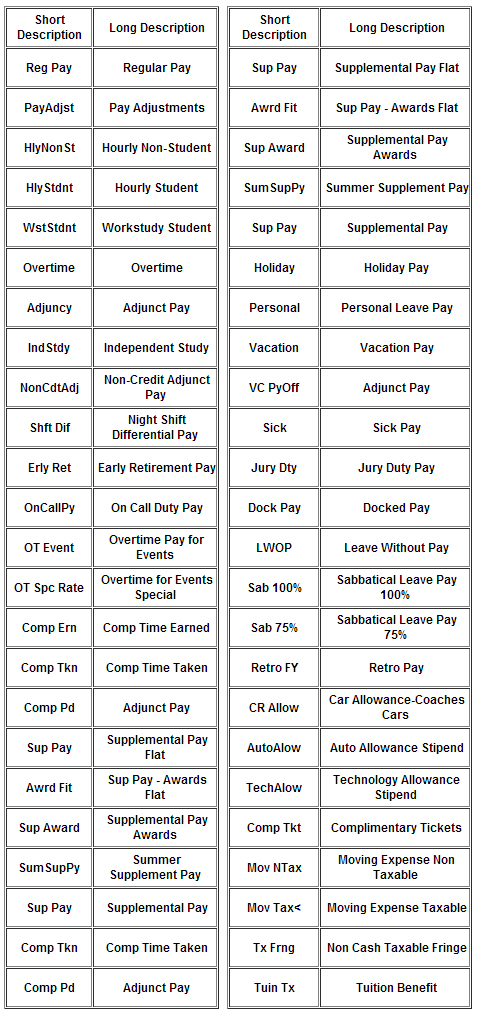

2 2Federal income tax FIT withholding Gusto Help Center. All but seven states AK FL NV SD TX WA and WY have state income taxes. 3 3PDF Deduction Gross pay State income tax SIT.

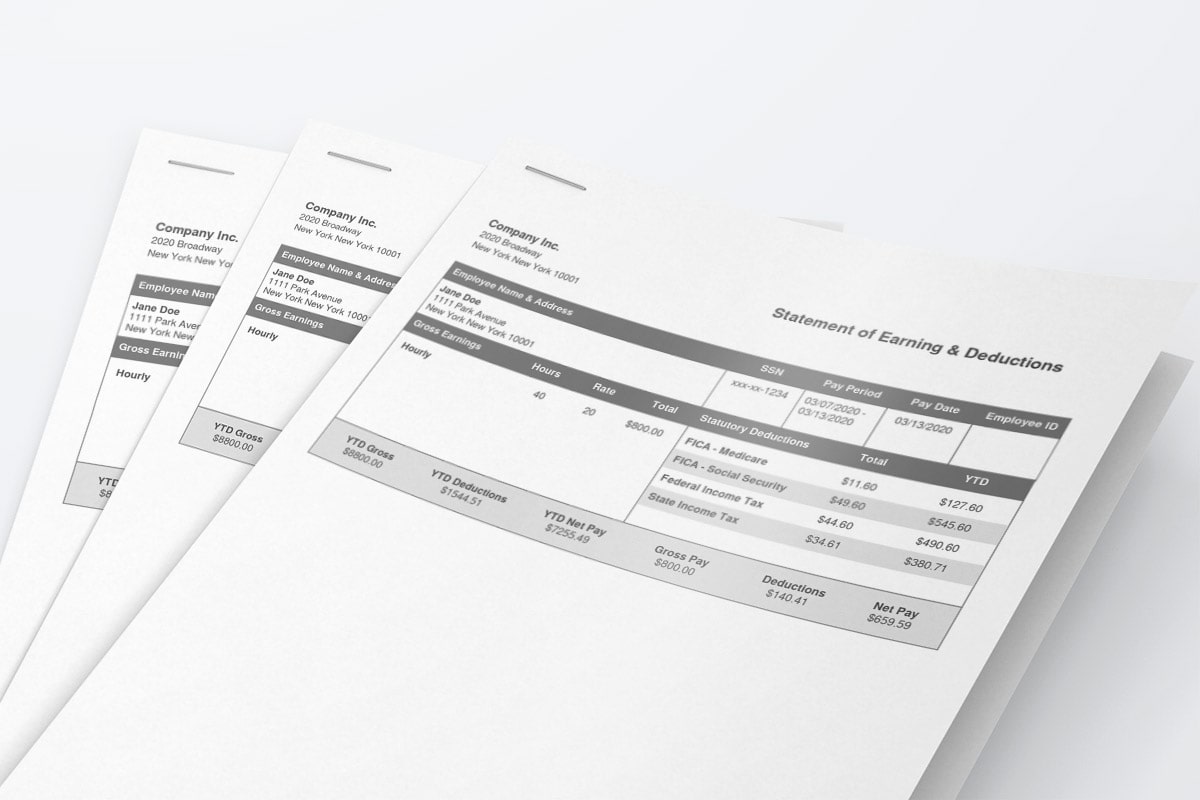

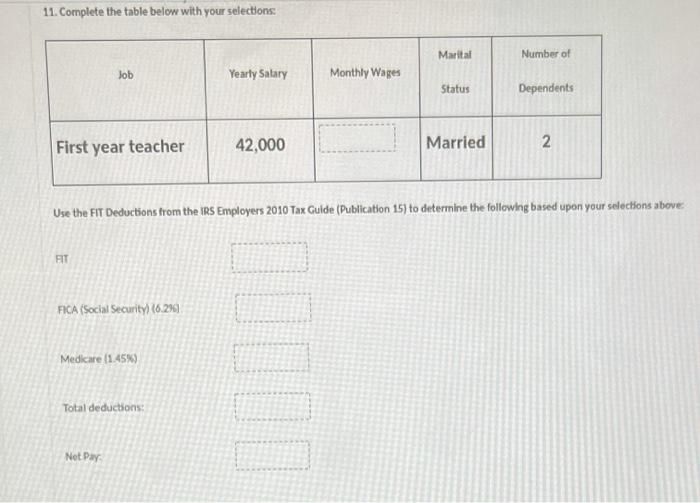

A salaried employee is paid an annual salary. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an. Net pay Net pay is the amount you take home after deductions.

Some are income tax withholding. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. The result is that the FICA taxes you pay are.

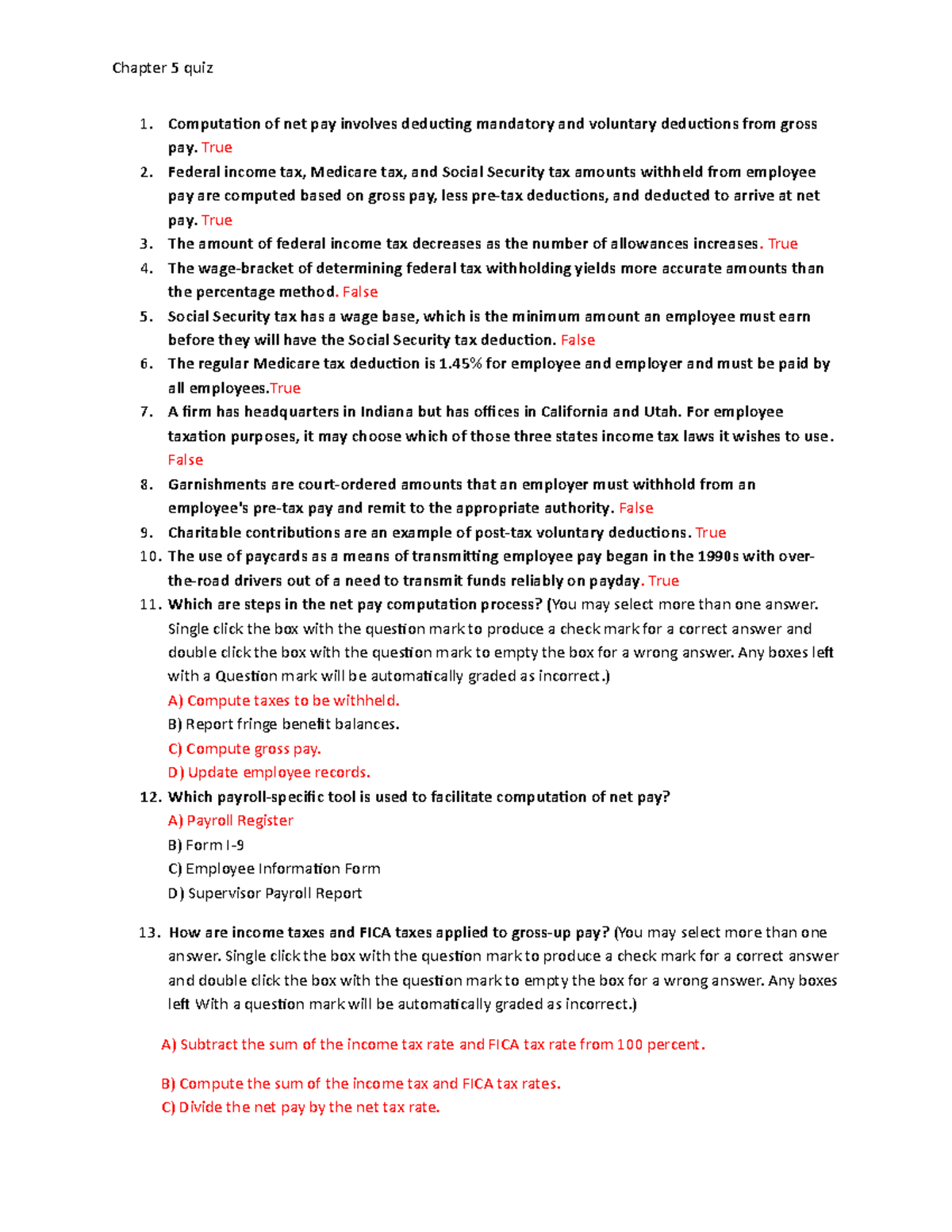

This is the information about your specific job. There are a few things you should know about fit deduction on your paycheck. This section shows the beginning and ending dates of the payroll and the actual pay date.

Withholding is one way of paying. This is your Federal and. Fit is the amount required by law for employers to withhold from wages to pay taxes.

Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. FIT tax refers to Federal Income Tax.

With this information you can prepare for tax season. However they dont include all taxes related to payroll. Refund used to pay other debts.

FICA taxes consist of Social Security and Medicare taxes. Lets say the annual salary is 30000. These items go on your income tax return as payments against your income tax liability.

That annual salary is divided by the number of pay periods in the year to get the gross. This is your home address. FIT Fed Income Tax SIT State Income Tax.

The amount of FIT withholding will vary from employee to employee. Sometimes you or your spouse may owe a tax debt to the IRS or a debt to other agencies including child support or student loans. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities.

An individuals paycheck for state income taxes. FICA taxes are commonly called the payroll tax. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable.

For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their. Federal income taxes are.

2022 Federal Payroll Tax Rates Abacus Payroll

How To Automate Payroll And Taxes Workest

Why Did My Federal Withholding Go Up

Take Home Pay The Deductions Taken Out Of Your Paycheck Help Support Schools Roads National Parks And More Why Do You Think You Have To Pay Taxes Ppt Download

What Is The Fit Deduction On My Paycheck

What Are Pay Stub Deduction Codes Form Pros

How To Make Sense Of Your Paycheck Credit Com

How To Calculate Federal Income Tax

Understanding What S On Your Paycheck Xcelhr

Explaining Paychecks To Your Employees

Understanding Your Paycheck Credit Com

Hrpaych Yeartodate Payroll Services Washington State University

How To Read Employee Pay Stubs Gtm Business

2 1 F Ederal I Ncome T Ax Fit Federal Income Tax Is Money Withheld By Employers Required By Law Amount Is Dependent On How Much Is Made Taxes Are Used Ppt Download

Paycheck Calculator Online For Per Pay Period Create W 4

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com